Employees are now able to access Employee Commencement Forms such as the TFN declaration through ATO Online in myGov when they commence a new job. This new method is referred to as onboarding.

The online forms available are:

• Tax file number declaration

• Superannuation (super) standard choice

• Withholding declaration

• Medicare Levy Variation declaration.

All employees can access the new service through their myGov account, but will be directed to their employer in the first instance to get the necessary information to complete the form.

OPTION 1 – EMPLOYEE ACCESS DIRECTLY VIA MYGOV

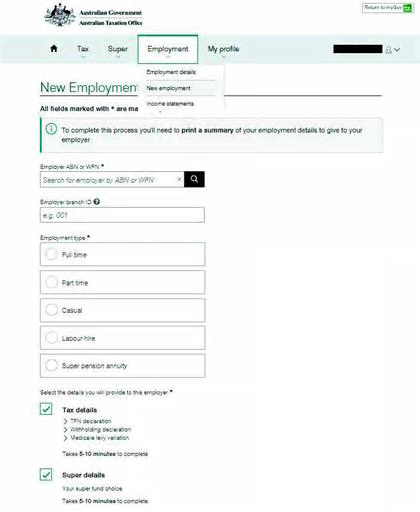

Employees can now access and complete pre-filled commencement forms through ATO Online via myGov. The forms are accessed by either:

• My profile > Employment; or

• ‘New employment’ on the home screen.

Employees should talk to their employer before they use these forms. To complete the forms, employees need to know the:

• employer’s ABN

• employment type (for example, full time, part time, casual)

• employer’s default super fund details

• name

• unique superannuation identifier (USI)

• ABN.

On the ATO Online screen, an employee will:

• view pre-filled information about their tax affairs (e.g., residency status and education loans)

• see information related to their superannuation, including their existing funds and the employer’s default fund

• complete and submit the employee commencement forms to the ATO electronically

• need to print the form and provide a copy to their employer.

If an employee makes a mistake in the form they can update it through myGov in ATO Online and provide a new version to their employer. Employees can also make updates to previous forms if their circumstances change, for example a change in their residency or finalisation of a Higher Education Loan Program (HELP) debt. The withholding declaration will no longer be used to facilitate these changes.

The employer will:

• enter the information into their system and keep a copy of the form for their records.

• not need to send the printed form to the ATO.

OPTION 2 – EMPLOYER’S SOFTWARE LINKING TO FORMS IN MYGOV

The specifications are now available for software developers to build this service. Employers should check with their software provider to find out when this service will be offered.

With this service, employers can allow their employees to access the ATO Online form via their own payroll software or onboarding solution. These forms would only be accessible from the link provided by the employer. An employee will need a myGov account linked to ATO Online.

Once the form is submitted, the employer’s payroll software will request the information from us via SBR2-enabled software. The information provided to the employer will include the employee’s tax file number, residency status, tax free threshold, Medicare levy details and chosen super fund.

WITHHOLDING DECLARATION NOT REQUIRED FOR ONBOARDED EMPLOYEES

Employees who have used the new onboarding method for completing their TFN Declaration will not complete a withholding declaration to advise their employer of a change in circumstances. Instead they will make these changes online via myGov, print out the new details and give it to their employer. The employer will keep the information on file. It will not be sent to the ATO.

The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained. DGL Accountants are here for you every step of the way, contact us today.